Controlling prices: Difference between revisions

No edit summary |

No edit summary |

||

| Line 21: | Line 21: | ||

<span class="chiffre">2</span> Purchase price in article points. Careful! If the value is displayed in euros then that means that your catalogue was not set up in [[Setting up your suppliers]]. | <span class="chiffre">2</span> Purchase price in article points. Careful! If the value is displayed in euros then that means that your catalogue was not set up in [[Setting up your suppliers]]. | ||

<span class="chiffre">3</span> Point value set in [[Setting up your suppliers |Setup | Pricing | Supplier]]. Here, | <span class="chiffre">3</span> Point value set in [[Setting up your suppliers |Setup | Pricing | Supplier]]. Here, €0,2. | ||

<span class="chiffre">4</span> Base purchase price excl. taxes calculated by multiplying the price in article points by the point value. Here, 1000 x 0,2=€200. | <span class="chiffre">4</span> Base purchase price excl. taxes calculated by multiplying the price in article points by the point value. Here, 1000 x 0,2=€200. | ||

| Line 29: | Line 29: | ||

If Sale coefficient in relation to catalogue price is selected instead, then the sale price will not take into account the 10% manufacturer discount. | If Sale coefficient in relation to catalogue price is selected instead, then the sale price will not take into account the 10% manufacturer discount. | ||

<span class="chiffre">5</span> Recommended purchase coefficient, set up in [[Setting up your suppliers|Setup | Pricing | Supplier]]. Here, 200x09= | <span class="chiffre">5</span> Recommended purchase coefficient, set up in [[Setting up your suppliers|Setup | Pricing | Supplier]]. Here, 200x09=€180 | ||

<span class="chiffre">6</span> Recommended sale coefficient, set up in [[Setting up your suppliers|Setup | Pricing | Supplier]]. Here, 2. | <span class="chiffre">6</span> Recommended sale coefficient, set up in [[Setting up your suppliers|Setup | Pricing | Supplier]]. Here, 2. | ||

| Line 35: | Line 35: | ||

<span class="chiffre">7</span> Net purchase price excl. taxes taken from the base purchase price excl. tax. | <span class="chiffre">7</span> Net purchase price excl. taxes taken from the base purchase price excl. tax. | ||

<span class="chiffre">8</span> Recommended sale price excl. taxes calculated by multiplying the Net purchase price excl. taxes by the Sale coefficient. Here, €200 x 1.8 (2x0.9) = | <span class="chiffre">8</span> Recommended sale price excl. taxes calculated by multiplying the Net purchase price excl. taxes by the Sale coefficient. Here, €200 x 1.8 (2x0.9) = €360 excl. tax. | ||

<span class="chiffre">9</span> Recommended sale price incl. taxes calculated by adding VAT to the Recommended sale price. Here, | <span class="chiffre">9</span> Recommended sale price incl. taxes calculated by adding VAT to the Recommended sale price. Here, €360 + 20% = €432 incl. tax. | ||

<span class="chiffre">10</span> VAT rate selected in [[Setting up your VAT rates|Scene | Information]]. | <span class="chiffre">10</span> VAT rate selected in [[Setting up your VAT rates|Scene | Information]]. | ||

Revision as of 13:20, 6 July 2023

|

There are several tools available to check your scene and avoid potential mistakes with the settings.

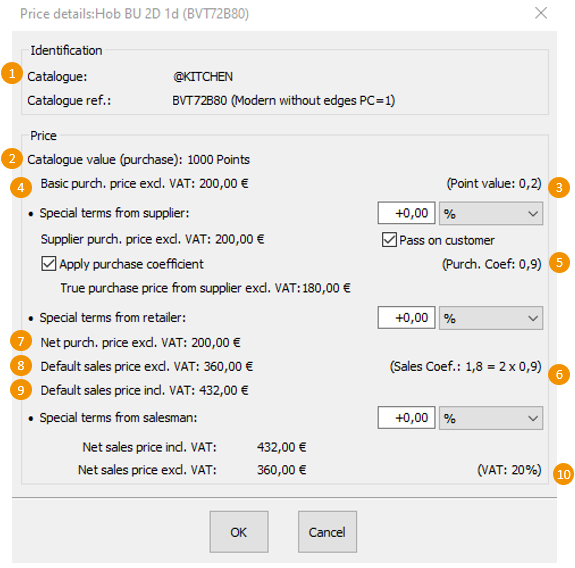

Right click on your article and select Price. A window will open up with a summary, allowing you to check all the information in the blink of an eye.

2 Purchase price in article points. Careful! If the value is displayed in euros then that means that your catalogue was not set up in Setting up your suppliers. 3 Point value set in Setup | Pricing | Supplier. Here, €0,2. 4 Base purchase price excl. taxes calculated by multiplying the price in article points by the point value. Here, 1000 x 0,2=€200. Purchase coefficient set in Setup | Pricing | Supplier. Here, 0,9. That means that the shop benefits from a 10% manufacturer discount. By ticking the "Sale coefficient in relation to purchase price" box in the supplier settings, you can extend this discount to the client. If Sale coefficient in relation to catalogue price is selected instead, then the sale price will not take into account the 10% manufacturer discount. 5 Recommended purchase coefficient, set up in Setup | Pricing | Supplier. Here, 200x09=€180 6 Recommended sale coefficient, set up in Setup | Pricing | Supplier. Here, 2. 7 Net purchase price excl. taxes taken from the base purchase price excl. tax. 8 Recommended sale price excl. taxes calculated by multiplying the Net purchase price excl. taxes by the Sale coefficient. Here, €200 x 1.8 (2x0.9) = €360 excl. tax. 9 Recommended sale price incl. taxes calculated by adding VAT to the Recommended sale price. Here, €360 + 20% = €432 incl. tax. 10 VAT rate selected in Scene | Information.

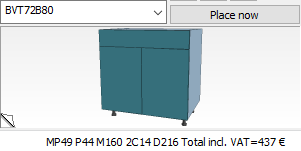

Checking your margins In the bottom right of InSitu, a line displays the summary of your project and allows you to check your margins very quickly.

Here is how to make sense of all the information in this line. CPx: Shows the chosen client profile PGxx: Shows the brand rate, taking into account the actual supplier purchase Pxx: The P refers the brand rate in %. Here, 50% Mxx: The M refers to the margin in € excl. taxes. Here, €200 xCxx: The C refers to the sale coefficient incl. taxes. Here, 2,4 Exxx: The E refers to the gap in euros with the floor price that you set while setting up the pricing. Here, €482.

|

|